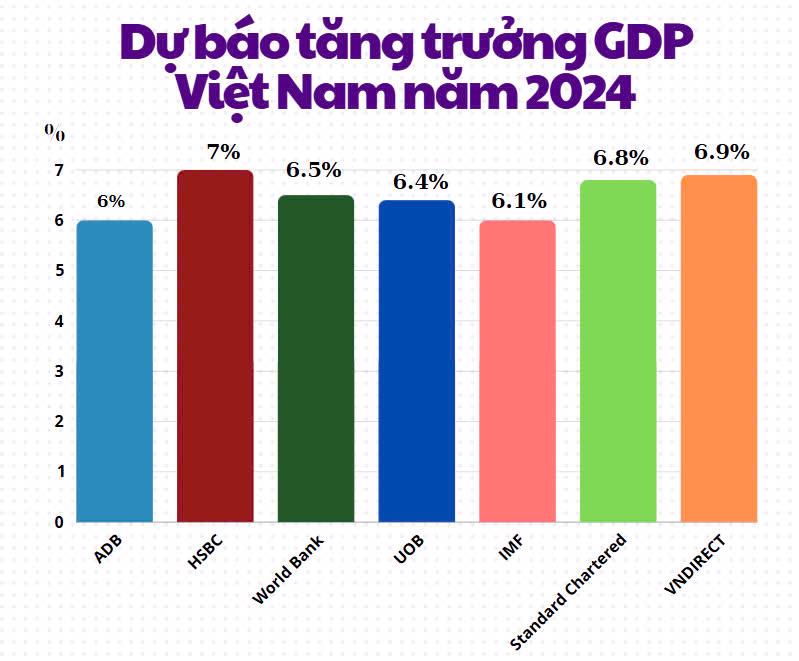

UOB forecasts Vietnam’s GDP growth to reach 6.4% in 2024 and increase to 6.6% in 2025, thanks to strong internal factors and improvements in many economic sectors….

Continuing the steady growth momentum in Q3/2024, UOB Bank forecasts that Vietnam’s economy will continue to grow well in Q4. Accordingly, Vietnam’s GDP growth is forecast to reach 6.4% in 2024 and increase to 6.6% in 2025.

THE GROWTH TRACTOR IS ON THE RIGHT DIRECTION

According to UOB, Vietnam’s real GDP growth performed better than expected in Q3/2024, rising sharply by 7.4% year-on-year, exceeding the market’s median forecast of 6.1% and UOB’s previous forecast of 5.7%.

“This is the highest growth rate since Q3/2022, when economic activities have recovered strongly from the bottom of the pandemic. This latest result has contributed to a cumulative increase of 6.82% year-on-year in the first nine months of 2024,” UOB experts commented.

Although major sectors were affected by the storm, agriculture, forestry and fisheries output in the third quarter of 2024 still increased by 2.6% year-on-year, said analysts at UOB.

Notably, manufacturing output continued to accelerate by 11.4% year-on-year from 10.4% in Q2 2024. The services sector grew by 7.5% year-on-year after a 7.1% increase in Q2 2024.

In Q3 2024, the services sector was the main driver of GDP growth with 3.24 percentage points, followed by industry and construction with 3.37 percentage points, accounting for 89% of the overall increase of 7.45.

At the same time, the latest published data also showed that Vietnam’s growth trajectory remains on track. As of October, Vietnam’s exports increased by 14.9% year-on-year, maintaining double-digit growth momentum so far.

For the full year of 2024, UOB forecasts Vietnam’s exports to grow 18%, which would be the strongest since 2021.

Meanwhile, imports grew 16.8% year-on-year in the year-to-date period to October, resulting in a trade surplus of US$22.3 billion in the first 10 months of the year, the second-largest trade surplus on record after US$28 billion in 2023. The momentum in foreign direct investment (FDI) continues to expand, with registered FDI inflows of US$27.3 billion in the first 10 months of 2024, up 2% year-on-year.

Domestically, retail sales growth momentum in 2024 has remained largely stable so far, with an increase of 7.1% in October and an average year-to-date increase of 8.5% YoY. This was partly supported by a 41% increase in tourist arrivals, to 14.1 million visitors year-to-date through October.

“The increase was driven by the top tourist sources including: South Korea, China, Taiwan region, the US and Japan. However, compared to the pre-Covid-19 boom in 2019, tourist arrivals data has continued to decline and may take another one to two years to return to pre-pandemic levels,” said UOB experts.

Given these factors, UOB maintains its 2024 economic growth forecast for Vietnam at 6.4%, with a forecast for 4Q24 growth of 5.2% YoY.

GDP GROWTH IN 2025 AT 6.6%

For 2025, UOB forecasts a growth rate of 6.6%. According to UOB, the Vietnamese National Assembly has set a GDP growth target of 6.5 – 7.0% for 2024 and 6.5 – 7.0% for 2025, while “striving” to reach 7.0 – 7.5%.

“However, with the US preparing to enter a new presidential term, the possibility of global trade tensions and risks may soon emerge,” UOB experts recommended.

A key risk to note is potential trade restrictions on Vietnam, as the US’s annual trade deficit with Vietnam has increased more than 2.5 times from USD 39.5 billion in 2018 to nearly USD 105 billion in 2023.

According to UOB experts, with the economy still growing strongly this year and extending into 2025, the State Bank will not be under much pressure to loosen policy quickly.

Currently, the inflation index remains below the target of 4.5% since June 2023, thereby reducing much of the pressure on the operator.

“Given the continued rise in global trade tensions under President Donald Trump and the accompanying strength in the US dollar, the SBV will have to watch out for depreciation pressure on the VND. We expect the main refinancing rate to remain at 4.5%,” UOB experts forecast.

In addition, despite its solid foundation, the VND is still constrained by external factors such as the recovery in the US dollar as the market reprices the scenario of fewer rate cuts by the US Federal Reserve (Fed) during Trump 2.0.

Source: VNECONOMY

info@mplogistics.vn

info@mplogistics.vn (+84) 28 3811 9033

(+84) 28 3811 9033

VN

VN