Vietnam’s fruit and vegetable market is undergoing a clear structural shift as imports from the United States expand rapidly. Strong consumer demand for premium produce, favorable tariff adjustments, and the continued growth of modern retail channels have accelerated the inflow of US fruits and vegetables into the country.

This import-driven trend reflects Vietnam’s rising consumption capacity and highlights the growing role of imported produce in shaping the current market landscape.

Accelerating Imports of US Fruits and Vegetables into Vietnam

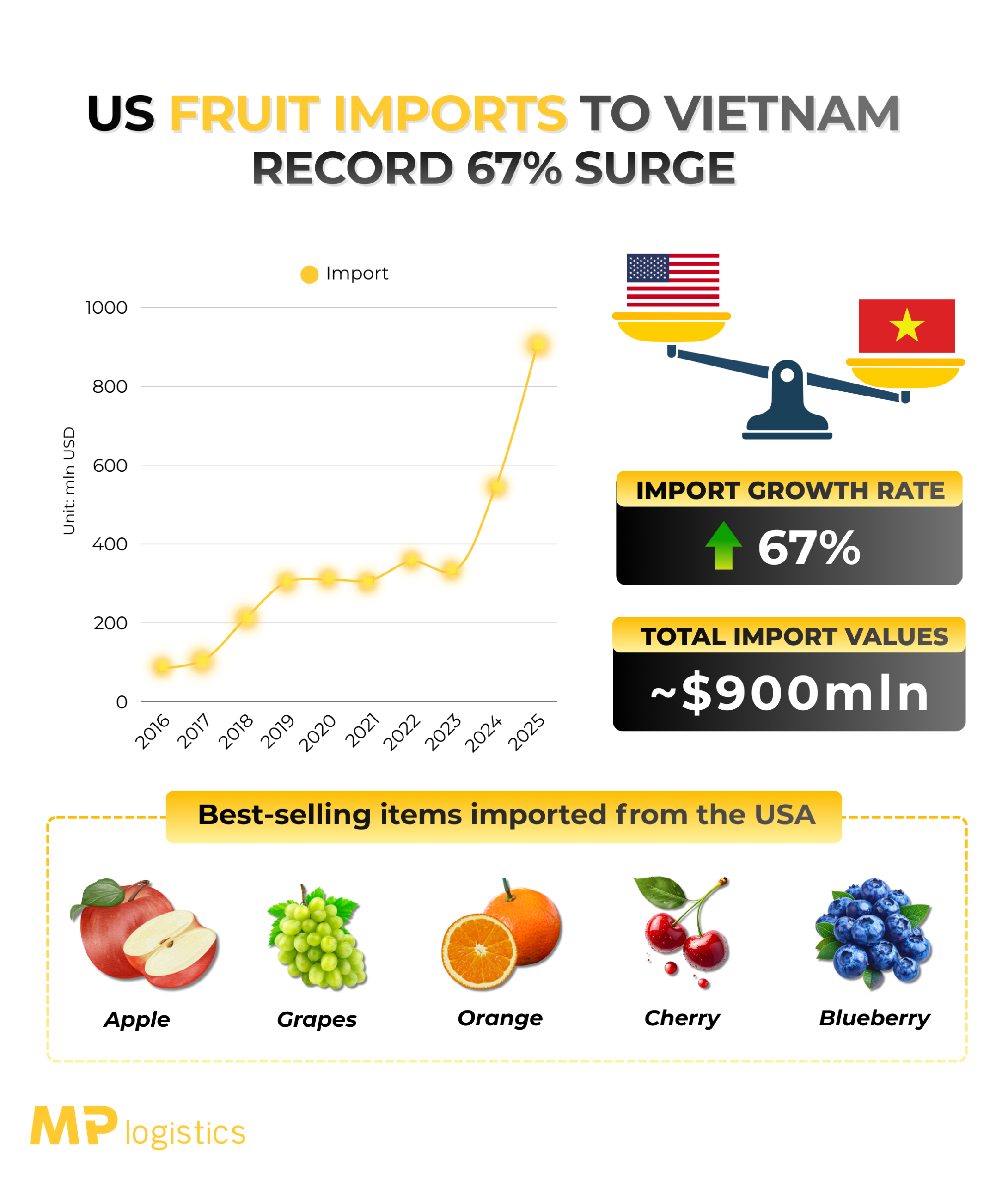

Imports of US fruits and vegetables into Vietnam gained strong momentum in 2025. Total import value increased by nearly 67% year-on-year, exceeding USD 900 million. Over the past decade, imports from the United States have expanded more than tenfold, rising from approximately USD 85 million in 2016 to current levels. This sustained growth confirms the increasing importance of US produce within Vietnam’s import structure.

US fruits and vegetables now appear widely across Vietnam’s modern retail ecosystem. Supermarkets, convenience stores, and premium fruit shops regularly stock cherries, apples, grapes, blueberries, oranges, and almonds. Consumers often associate these products with stable quality, strict food safety standards, and strong brand credibility. As a result, US produce has secured a clear premium positioning in the Vietnamese market.

Policy factors have further supported this growth. In April 2025, tariff adjustments reduced import duties on selected agricultural products. These changes improved the price competitiveness of US fruits and vegetables relative to other origins. Vietnamese importers responded by expanding sourcing from the United States, particularly to meet demand in major urban centers where consumers show a strong willingness to pay for imported produce.

Market Impact and Import-Led Outlook

Market Impact and Import-Led Outlook

The growing inflow of US fruits and vegetables is reshaping Vietnam’s domestic market, especially in the premium segment. Imported products such as cherries, apples, and grapes are increasingly favored during festive seasons and gift-giving periods, reinforcing their status as high-value consumer goods.

However, import-led growth also intensifies competition within the local market. Long transportation distances and cold-chain requirements keep US produce relatively expensive, but strong demand has so far absorbed higher prices. This dynamic places pressure on domestic producers, particularly those operating in higher-value segments.

Looking ahead, imports of US fruits and vegetables are expected to remain a key driver of market development in Vietnam. Continued growth in modern retail, stable tariff conditions, and evolving consumer preferences will likely sustain import momentum. At the same time, rising imports may encourage improvements in logistics, cold-chain infrastructure, and quality standards across the broader agricultural supply chain.

Overall, the surge in US fruits and vegetables imports into Vietnam reflects an increasingly import-oriented market structure. While this trend enhances consumer choice and market diversity, it also underscores the growing influence of imported produce in shaping competition, pricing, and trade dynamics within Vietnam’s fruit and vegetable sector.

info@mplogistics.vn

info@mplogistics.vn (+84) 28 3811 9033

(+84) 28 3811 9033

VN

VN